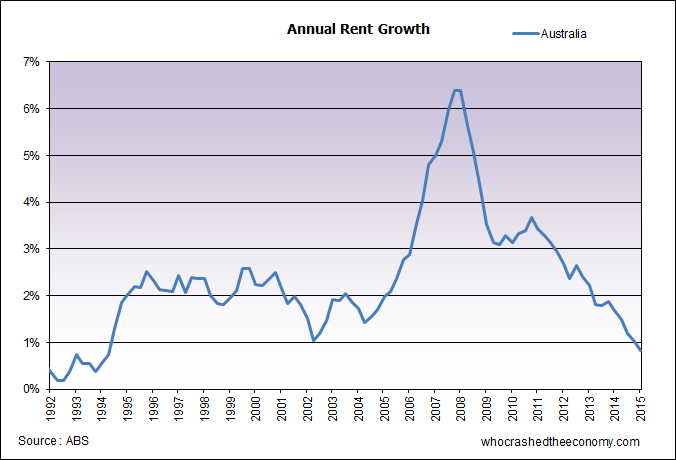

Australia’s rental market is starting to resemble a disaster zone as an oversupply of rentals flood the market at a time of anemic wage growth. Australian Bureau of Statistics figures released today show rent growth is now the lowest in 21 years, at just 0.82 per cent for the year to December 2015.

Mining dominated cities Perth and Darwin are leading the way with rents falling 2.22 per cent and 2.43 per cent respectively for the year. Most of the declines were attributed in the last quarter with rents falling in Perth 1.34 per cent and Darwin, 1.32 per cent.

Canberra notched up its tenth quarter of falls or zero gains. On average, rents there have been steadily falling 0.39 per cent per quarter.

But experts say the figures could be distorted as desperate landlords of vacant rentals resort to providing free iPads, removalists, gift vouchers and rent free periods in an increasingly worsening market.

Agents are encouraging landlords to provide free gifts rather than slash rents to help “prop up” the figures and keep the banks at bay.

Pointless to include rents from mining areas, as they would have peaked at some ridiculous level during the boom, so they have to drop a lot during the bust phase.

I can see many rental houses on my area, sydney ride, as new apartments are being completed. Prices that the apartment rental havent been dropped, which make me surprise. Still there are people to rent house or owners who not care of house not be rented.

Heard many owners of the new apart are in china,,,,

Should put much higher tax on the people who not contribute Aus at all!!

It doesn’t make for pretty reading if you’re a homeowner in Sydney, does it?

Half of Sydney is up for lease it seems. TOT dropped again in December.

The ones who wanted everything now are experiencing cut after slice, after cut. I don’t drive a Porche SUV and my sweat is created by working in the heat. The “Jones” in my street get very upset when I say “no debt, no assets”…they see that NOW as gloating. Fuck me!?!?. I go overboard I guess when I moon them a more glamorous arse. A debt free arse.

It was never theirs. It was borrowed when the perks seemed like they’d go on forever.

Can’t say this is much of a surprise. Everyone you speak too wants to be a landlord with multiple properties. Where are all the tenants going to come from?

If you think the oversupply is scary now(Almost 20pc of Melbourne’s investor-owned homes empty), wait until you see all the new apartment towers that will flood the market in the next two years, everywhere from Melbourne, Sydney to Brisbane. Going to be a lot of investors stung with off the plan.

Drove through inner Brisbane this morning and I was truly shocked at the amount of cranes working on new apartment blocks. There is already a bit of a glut of these newish apartments so in six to twelve months time things are going to get very ugly.

The Tiny House movement will no doubt give landlords a bit of anxiety. The couple in the youtube vid have built their own small home with what they would have spent on two years average rent in New Zealand.

https://youtu.be/f3SwqNzsNwg

The numbers stopped making sense a long time ago. 1 bed apartment 800k in Sydney. As an investor, if you buy in cash, one needs almost 30 years of rental income before you make $1 profit. And that’s only if you have no maintenance and strata costs. If you borrow the money that is 80 years of rental income minimum until that unit pays for itself. Investment ? So who are the people buying off plan in cash ?

What everyone here is realizing is an economic or housing boom of which the government will use as an excuse to pat itself on the back and claim credit for job creation. What is misleading is, as with all government statements is that it is debt fuelled and temporary and all subsidized by the taxpayer. The truth is our money is going to make vested interests even more rich. WAKE UP!! everyone. Be very critical with politicians. They are the only reason there is no true economic growth. Don’t vote for them blindly.

Speaking of misguided statements Theo, can you explain how job creation is subsidised by taxpayers?

Not related to rents but property prices in Sydney between Ryde & Northmead in general, one thing I have noticed is that properties where specific prices were listed last year are now showing a price range but one that is greater than last year where the property didn’t sell!!!!

E.g. a 2 bedroom unit in Northmead originally advertised at $560k dropped asking price to $550k in November 2015 & now has a price range advertised as being $570-$610k

A 3 bedroom unit in Rydalmere advertised at $730k around October last year is listed as $730-$780k now

…interesting how when a place doesn’t sell at a particular price, agents think upping the price will result in a sale….unsurprisingly all the properties I’ve seen where this tactic has been employed, haven’t sold.

While not directly related to the Oz housing bubble, this is something I’ve pointed out before:

http://timiacono.com/index.php/2016/01/27/two-term-presidents-and-u-s-stocks/

When America sneezes,…

Story in UK press today on record migration from Australia back to NZ… with kiwis seeking “economic stability”.

http://www.bbc.co.uk/news/world-australia-35467125

Sorry to be off-topic. Looks like, the great contraction ahead.

http://www.abc.net.au/news/2016-02-04/shell-confirms-job-cuts-as-profit-plunges-on-low-oil-prices/7141816?section=business

80 million dollars for a house in the eastern ‘burbs of harbour front Sydney. Don’t we realise that this inequality has destroyed our childrens future. This city has become the biggest rip-off in the world. High debts and low job security with locals priced out of the market. Greed is promoting criminal activities. Our grandparents would be devastated at what this nation has become. If it wasn’t for the corruption of the vested interests this bubble would have burst years ago. Debt does not create wealth. It is the money masters trap that is modern slavery.

I think rentals are going to be a thing of the past this year. Who knows this might prove a good opportunity for property selling. forsaleforlease.com.au have some great articles and blogs if you want to engage in real estate. realestate.com.au has some interesting articles as well.

Quick ban negative gearing immediately, that will force rents up!

It’s all about where to stash your cash. My house has risen in value over the last couple of years and I could sell at an OK profit, tempted to sell however what do I do with the money? Stocks, not likely. Banks, don’t trust they are as secure as they claim.

As such decided to keep the property and rent it. Tenant is paying a good price, would calculate getting an ROI of about 4.5%, not mind-blowing but OK, and the investment is safe. If things went bad I can drop the rent as have no debt, less return but still a cash-flow.

I really don’t like the looks of the world economy, and as such although want a return, security right now is paramount. Am expecting property to tank in price but to still be the less ugly alternative.

Yep looks like I was right

https://youtu.be/5ZRwOyjWoWU

Investors looking for that winning edge!

https://www.youtube.com/watch?v=DO1Q7F23DxM

Watching the news tonight.

I hear that Bill Shorten says he will end Negative Gearing for purchases of existing properties if elected at the next election.

Sorry here is the link:

http://www.9news.com.au/national/2016/02/12/18/38/bill-shorten-poised-to-tackle-negative-gearing-with-new-policy

If PI magazine can’t pick a winner, what hope does the average infestor have?

http://www.macrobusiness.com.au/2016/02/2012-property-investor-of-year-goes-bust/

@ Tony (Comment 11)

That is a standard sales tactic. Ive seen so many properties sell for more than what they were previously advertised for. I’ve even done it myself.

@Bubbly (comment 21)

Interesting times. Given that the greens have largely the same policy, I wonder if Greens preferences will be given to Labor at Federal election later in the year?

Kinda puts the onus on Malcolm Turnbull to come up with some meaningful tax reform now that 15% GST is dead. I wonder if he’ll scale back negative gearing & CGT discounts or hedge his bets that there are enough Boomers with vested interests to carry him over the line. The fact he is better than Abbott & more likeable than Shorten won’t be enough. It’s policy time Turnbull.

@ mark

Yeah was reading that yesterday. Just goes to show how ridiculous those magazines are and how much they actually contribute to the problem by publishing this kind of garbage property porn. I can imagine a lot of people followed their example after reading about them in that stupid PI magazine and are now in a similar situation.

This is just completely irresponsible on her part, I know some will try to blame the banks but also remember that they were the ones who continually approached the banks, nobody forced them to take out those loans.

Her bio page seems strange its like she is in denial or the fact that it wasn’t her money that she burnt seems to make it all not matter.

“Hey everyone look at me! I borrowed a tonne of money that wasn’t mine, burnt it all and now don’t have a chance of ever paying it back in my lifetime but oh well! I’m as happy as can be because IT WASN’T MY MONEY!”

Towards the bottom of the page:

“Kate Moloney is an empowering motivational speaker and author. She loves combining entrepreneurship and property investing with personal development and empowerment.”

How could someone who is such a failure describe themselves like this!? and who the heck would want to take advice from someone who has shown complete idiocy in investment.

Also what happens to people like this? They end up in massive debt and I assume the banks may take their properties and force them into bankruptcy. It sounds like they still have the properties and are in arrears with payments but so far the banks have not foreclosed on them (probably because they know once they do they will no longer service the loans at all and will walk away from the debt)

But say a person borrows and then loses heavily and gets foreclosed on with massive debts such as this. Does that debt stay with them for the rest of their life or do they get to walk away with a clean slate after a few years? Will the banks continue to pursue them to make payments for the rest of their lives?

Last time I was administering small loans, bankruptcy in Australia generally means no loans for three plus years. Bankruptcy stays on credit reports for a minimum of five years.

More information here (Australian Financial Security Authority):

https://www.afsa.gov.au/debtors/bankruptcy

and here:

https://www.afsa.gov.au/debtors/bankruptcy/consequences-of-bankruptcy