Performance Property Advisory believes Sydney property prices have “reached a classic peak” and have issued a “sell” rating according to the Australian Financial Review (‘Sydney and Melbourne property ‘set for price correction.’) The group provides market research and analysis for medium to high income professionals.

According to the Domain, Sydney house prices have surged 52.5 per cent in the past three years. Over the same period, CPI increased just 6.2 per cent meaning house prices outpaced inflation almost 8.5 times.

“The market is just too expensive to keep running. The bulk of potential buyers cannot afford to compete. We will have to see three to four years of wage growth before it returns to normal levels, ” commented David McMillan, a principal at Performance Property Advisory.

McMillan was unwilling to speculate on how far prices will fall.

We reported last year (‘NAB restricts lending in 34 Sydney bubble suburbs‘ – Sep 28th) the banks had made decisions to restrict lending to many suburbs “exhibiting characteristics that may indicate future deterioration in credit risk”.

According to the Domain Group, Sydney house prices have now recorded their largest quarterly fall on record, plunging 3.1 per cent in the December 2015 quarter.

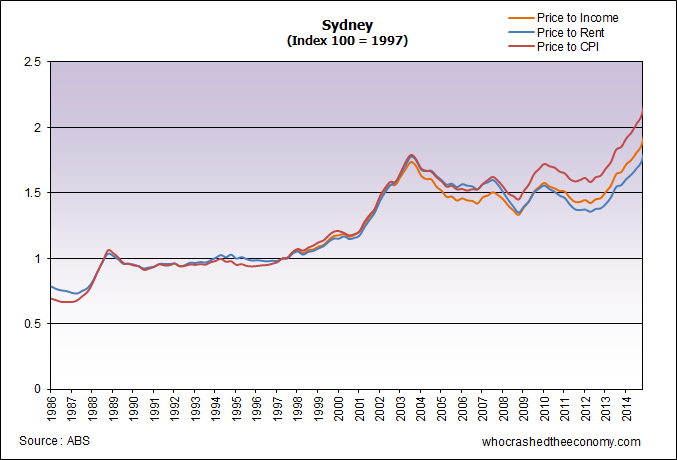

Economists who study housing bubbles and long term price trends have found, logically, house prices generally do not appreciate faster than household income, or the ability to service the mortgage/debt. In comparing markets, they often compare the change in the ratio of house prices to income and house prices to rents. In a normally functioning market, both should rise at roughly the same rate and should be flat (cancel each other out), like in the case pre-bubble 2001. Once the bubble bursts, these ratios generally return to mean like was the case with the USA subprime housing bubble.

Our data would suggest Sydney house prices are 48.8 per cent overvalued on a price to rent metric and 52.2 per cent overvalued on a price to income metric.

Both rents and incomes have increased faster than inflation during the boom years, and are now showing signs of stress. (‘Rental growth slowest in 21 years‘), (‘Falling wages to upset household debt dynamics‘) Larger falls could be witnessed if rents and wages were to fall, or if confidence is eroded to the point that the market undershoots. The real house price index (Price to CPI), suggests Sydney could be as much as 57.4 per cent overvalued.

» Sydney and Melbourne property ‘set for price correction’ – The Australian Financial Review, 19th February 2016.

All together now “Here we go, here we go, here we go…”

Amusing that….’McMillan was unwilling to speculate on how far prices will fall’.

OK, can we safely say now that there has never been a better time to sell?

Frederic Bastiat : “When plunder becomes a way of life for a group of men living together in society, they create for themselves in the course of time a legal system that authorizes it and a moral code that glorifies it.”

Socialism for the rich.Capitalism for the poor. Rich people make mistakes, they don’t get punished. Poor people make mistakes, they get punished and then they are forced to pay for the mistakes of the rich .

Negative Gearing does not work in a falling market with no capital gains…………. Problem solved.

Property values always return long term to just above inflation levels. ……………..Problem solved.

Current politicians will always be voted out if real estate values decline……… Problem solved.

Certain metro areas within the the global housing ponzi seem to be driven more by cash purchases from foreign buyers, as a huge tidal wave of electronic credits searches for safety in tangible assets. Other areas further away from international airports tend to be more debt driven as hopeful investors take on unrealistic levels of debt, in order to get on the mythical “property ladder”. Both these massive distortions are artifices of government interference in the real economy. Firstly by allowing the fraud of ” fictional reserve banking” to continue, and secondly by pouring petrol on the residential property “investment” market.

Still a lot of people in denial if you look at the comments on 60 minutes story from last night. No surprise its mostly from people involved in the business such as buyers agents, property speculation services, mortgage brokers, real estate etc…

https://www.facebook.com/60Minutes9/videos/929420677127248/

So Sydney could be 60% overvalued. Then deduct from that nearly 50% devaluation of local dollar, in the past 5 years, looks like we are about to experience the scam of the century.

It has never been a better time to buy – RIGHT?

Safe as houses – RIGHT?

“We will have to see three to four years of wage growth before it returns to normal levels”

Wages have never grown at the rate, and never will. This guys math is as flaky as dandruff. Wages are actually going backward, our standard of living is decreasing.This, and household debt, is the unavoidable reasons why a correction will occur.

And the failed property investors want to blame the bank for lending them too much……

Hang on, aren’t these ‘property’ investors, the exact same kind that ridicule my wife and me for NOT jumping into debt upto our necks????

Nope, sorry guys, you will never, ever get sympathy from me. You were greedy, stupid, and just to top it off, splashing and waving your ‘wealth’ in front of everyone you could.

….Now the next lot to be asking for relief and sympathy will be the -ve gearers….. Same deal idiots…. You want to own a loss making investment so you can get a tax write off each year, well you can suck up the consequences of that stupid plan also.

Us small business owners and ordinary wage earners have been used enough by the property sector, sooner or later, the entire property model is going to break in this country…..

And sadly, we wont be able to flaunt our riches in front of those who got burnt by property….but we’ve had to put up with it from them for years.

@12. Couldn’t agree more.

Yep, @12, spot on,

some of us have been working hard to build a traditional income and business, not just win in a rigged casino – it is high time both the scam and good decent work get exposed for what they are, one moral cancer, the other necessity.

Ross Ashcroft – Four Horsemen – Feature Documentary.”Central banks unregulated cheap money pumped up land values which created an unsustainable asset bubble in a world that once again operates a rigged tax system that enriches entrenched privilege. Neo-classical economics have ruined the life for the bottom billions tempted everyone into intergenerational conflict and created massive suffering that has no limits.”

@12 Spot on!

Kate blames the banks for lending her millions of dollars on multiple loans that all went belly up 2 – 3 years. But when does she ever blame Your Investment Property magazine for promoting all of this?

@12

Well said Matty.

I made a comment on Facebook regarding a company called Beyond Debt. One of those leach companies that charge upfront fees to manage those already hemorrhaging in oweings. “No assets, no debt and enjoying life” is what I said. Well the comments back made me think I was shortly to be hung from a tree. One woman called me a heartless bastard because I was unsympathetic to the fact her and hubby have had to sell two investment properties and now send the kids to the local public school.

The same woman I’m sure 5 years ago would have call me an idiot for renting.

It’s not just the market that’s distorted….

I realised this has been discussed before, but in today’s Sydney Morning Herald, there is a more detailed article regarding Kate and Matt Maloney, the former 2012 property investor of the year, who are now facing the real prospect of bankruptcy.

In one of the mining towns, they (Kate and Matt borrowed money from the bank to purchase a investment property in), the median price of a house has crashed from $750,000 back in 2012, to now $180,000, that’s a massive drop. Whether, this bubble burst spreads to the capital cities, only time will tell, but the crash above (see article below), is reminiscent of what happened in the USA with its subprime home lending that led to GFC.

http://www.domain.com.au/news/what-to-do-when-property-bubbles-burst-35-million-in-the-red-20160223-gn086p/

@ Patrick

Yep, and those kids are now going to grow up totally debt adverse. They will do anything not to get into debt. Remind you of any other generation in the last 100 years????

It’s hard enough to make money off of regular customers. How hard must it be to make money off of broke customers….. They wouldn’t be rip off merchants at work pretending to help the down and out would they????? Scum bags.

And we’re the heartless bastards. LMAO.

I once heard from an accountant that a farmer was about to lose their farm due to a tax audit. They hadn’t paid tax in years!…. The parents ignorance was unbelievable. The accountant asked how much money they had, and/or how much they can borrow to pay the tax owing…Of course they were at their credit limit…..

The mother then asks “Does this mean we are going to have to take the kids out of private school?”

The response was priceless “love, you’ll barely be able to afford to drive them to public school by the time this is done!”

It seems while the credit flows, the public at large scream ‘look at me, look at me”, then when SHTF, “Help me, help me, it’s not my fault”

Nah, I say BS. ‘LOOK AT ME. This is aaaaaaalllllllllllll f@#$%^g paid for!’

What these idiot credit suckers don’t realize. Is the last 30 years have been Australia’s most prosperous ever. They have literally gambled their retirement. Never again will regular wage earners have the ability to leverage at ratios of 20X, on assets that appreciate at 30+% YOY……

So just where is all that prosperity we earned? I don’t see ferrari’s and porsches in all these landlords driveways….. The answer is simple…..

Have you seen the size of the federal and state government incomes???? And have you seen the profits of the big 4???????

Give me $100k of equity in a bank over $100k in equity in a house any day…… One I can cash in 3 days…. The other…pfft, doesn’t pay to think about it.

@19 Yoda.

Oh, and she says suicide and depression is rampant…

Wanna talk of real suicide and depression???? 4 farmers ever week across Australia take their lives. When the do-gooders pull their anti-live trade stunts it’s even worse…. Business owners are in a similar position…. But amateur wanna be Trumps have made their own bed.

The property investors did it to themselves. I have zilch sympathy. How about the young couple who leave school to lead a simple life working in low paid jobs such as retail???? They have no hope of getting into property,,,, hows that for depression inducing???

Induced by greedy land lords.

My god, Australian’s really are a bunch of idiots. Nothing a dose of mathematics wont fix though.

I’ll just leave this here;

http://www.businessinsider.com.au/boom-towns-australian-property-and-the-lessons-from-the-irish-experience-2015-9

Just a few quotes from within how Australians have ignored the lessons that the Irish have learned the hard way;

“In the late 90s, house prices were surging. It started to look like a good investment. Soon people in their mid-20s were buying second properties.”

Sound familiar??

“After everything fell in a heap in Ireland, it became clear the banks had engaged in obscene levels of risky lending, especially to those large-scale property developers building huge residential projects. They put enormous liabilities on banks’ books and bankers were confident the money would come back. These lending practices were the cause of the true disaster that will now haunt Irish taxpayers for decades. The bailouts have now cost around €40 billion, or some $A60 billion on current exchange rates.”

The only winner in this scenario will be the banks, not the renters, savers, home owners etc. If it all got to pot all Australians are screwed!

@ Matty

Bada-Bing. Find you’re self in Sydney one day I’d like to buy lunch.

MSM and property try hards are all in damage control. I’ve seen a number of articles now that try to dispute the 60 minutes story and other recent reports. They use either the fact it only happened in a mining town therefore price drops won’t happen in cities, or they try to attack the credibility of Jonathan Tepper using the old claims of AUS is different somehow.

One of my best friends did reposessions of properties in the North East of England from 2009-2014. You wouldn’t believe the stories people had. The general gist of it was people on low-medium incomes had leveraged into a large number of property purchases. When the market turned they couldn’t afford to make up the shortfall.

Banks are still clearing out these properties from their books 7 years later. And as the landlords where going purely for returns, they tended to buy apartments in areas that weren’t quite rubbish, but weren’t great. So when the downturn came they where hit hardest because the people most likely to buy or rent it off them had cleared off to better areas as the opportunitys arose, or to chase jobs (i.e. people who are employed).

To me mining towns are the epitomoe of where this will go wrong. But also the less desirable areas in western Sydney will take a thumping or areas that are short of access to jobs & services.

Australia’s home bubble is insane…..

if you can sell yours….sell now asap…..

Then find a bench in a park and sleep under it….

– you will have a million dollars in the bank.